Hylton v United States: Apportionment of Direct Taxes

Historical

In Hylton v United States, the U.S. Supreme Court upheld an annual tax on carriages was a valid exercise of Congress’ constitutional authority. It specifically ruled that the tax was not a direct tax that required compliance with Article 1’s requirements for the apportioning of direct taxes.

The Facts of Hylton v United States

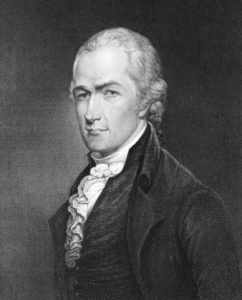

In 1794, Congress enacted a law entitled “An act to lay duties upon carriages for the conveyance of persons.” The statute levied a tax of sixteen dollars on each carriage owned by an individual or business. Daniel Hylton challenged the constitutionality of the law, arguing that it was a direct tax that had not been apportioned in accordance with Article 1. Alexander Hamilton, argued on behalf of the government before the U.S. Supreme Court.

The Legal Background on Hylton v United States

Prior to the enactment of the Sixteenth Amendment, the U.S. Constitution mandated that all direct taxes be imposed in proportion to each state’s population. Pursuant to Article 1, Section 2:

Representatives and direct Taxes shall be apportioned among the several States which may be included within this Union, according to their respective Numbers, which shall be determined by adding to the whole Number of free Persons, including those bound to Service for a Term of Years, and excluding Indians not taxed, three fifths of all other Persons.

Article 1, Section 9 further stated: “No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or Enumeration herein before directed to be taken.”

The Court’s Decision on Hylton v United States

The Court upheld the tax. As was the custom at the time, each of the justice wrote separately.

Justice Samuel Chase wrote, “As I do not think the tax on carriages is a direct tax…I am for affirming the judgment of the Circuit Court.” Justice William Paterson wrote, “All taxes on expenses or consumption are indirect taxes. A tax on carriages is of this kind, and of course is not a direct tax…I am, therefore, of opinion, that the judgment rendered in the Circuit Court of Virginia ought to be affirmed.”

The case was the first to address the constitutionality of an act of Congress. However, because the law was ultimately upheld, it is not regarded with the same significance as the Court’s later decision in Marbury v. Madison.

In his opinion, Justice Chase acknowledged what was likely on the horizon, writing:

As I do not think the tax on carriages is a direct tax, it is unnecessary, at this time, for me to determine, whether this court, constitutionally possesses the power to declare an act of Congress void, on the ground of its being made contrary to, and in violation of, the Constitution; but if the court have such power, I am free to declare, that I will never exercise it, but in a very clear case.

Previous Articles

SCOTUS Decision in Bowe v. United States Is First of the 2026 Term

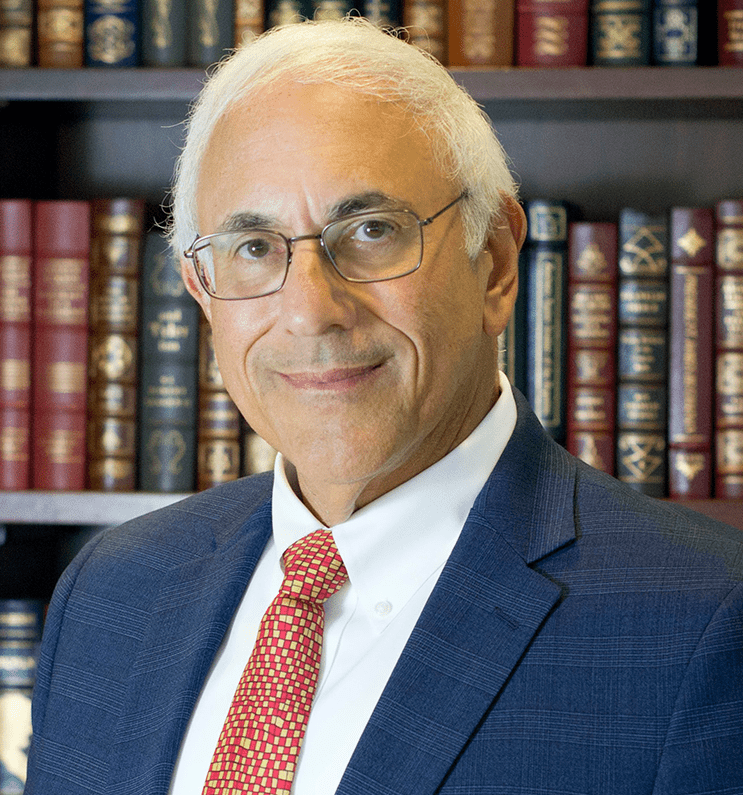

by DONALD SCARINCI on February 5, 2026

In Bowe v. United States, 607 U.S. ___ (2026), the U.S. Supreme Court held that Title 28 U.S.C. § ...

SCOTUS Rules State Can’t Immunize Parties from Federal Civil Liability

by DONALD SCARINCI on January 29, 2026

In John Doe v. Dynamic Physical Therapy, LLC, 607 U.S. ____ (2025) the U.S. Supreme Court held that...

Supreme Court to Address Racial Discrimination in Jury Selection

by DONALD SCARINCI onWhile the U.S. Supreme Court has concluded oral arguments for the year, it continues to add cases t...

The Amendments

-

Amendment1

- Establishment ClauseFree Exercise Clause

- Freedom of Speech

- Freedoms of Press

- Freedom of Assembly, and Petitition

-

Amendment2

- The Right to Bear Arms

-

Amendment4

- Unreasonable Searches and Seizures

-

Amendment5

- Due Process

- Eminent Domain

- Rights of Criminal Defendants

Preamble to the Bill of Rights

Congress of the United States begun and held at the City of New-York, on Wednesday the fourth of March, one thousand seven hundred and eighty nine.

THE Conventions of a number of the States, having at the time of their adopting the Constitution, expressed a desire, in order to prevent misconstruction or abuse of its powers, that further declaratory and restrictive clauses should be added: And as extending the ground of public confidence in the Government, will best ensure the beneficent ends of its institution.