Franchise Tax Board of California v Hyatt: Applying the Full Faith and Credit Clause

Franchise Tax Board of California v Hyatt: Applying the Full Faith and Credit Clause

On April 19, 2016, the Supreme Court reached another 4-4 tie. In Franchise Tax Board of California v Hyatt, the justices could not decide whether to overrule Nevada v. Hall, 440 U.S. 410 (1979), a case authorizing citizens of one state to sue the officials of another in their local courts. The justices did, however, decide a second issue before the Court, holding that Nevada’s actions in the case amounted to a “‘policy of hostility to the public Acts’ of a sister State,” in violation of the Constitution’s Full Faith and Credit Clause.

The Facts in Franchise Tax Board of California v Hyatt

Gilbert Hyatt maintains that he moved from California to Nevada in 1991. However, the Franchise Tax Board of California claimed that he actually moved in 1992 and thus owes California millions in taxes, penalties, and interest. Hyatt filed suit in Nevada state court, which had jurisdiction over California under Nevada v. Hall, seeking damages for California’s alleged abusive audit and investigation practices.

California sought to dismiss the case pursuant to a California state law granting immunity. In Franchise Tax Bd. of Cal. v. Hyatt, 538 U. S. 488 (2003), the Supreme Court affirmed the Nevada Supreme Court’s ruling that Nevada courts, as a matter of comity, would immunize California to the same extent that Nevada law would immunize its own agencies and officials. The case was remanded for trial, and Hyatt was awarded almost $500 million in damages and fees.

On appeal, California argued that the Constitution’s Full Faith and Credit Clause required Nevada to limit damages to $50,000, the maximum that Nevada law would permit in a similar suit against its own officials. The Nevada Supreme Court, however, affirmed, ruling that the $50,000 maximum did not apply.

The Legal Background of Franchise Tax Board of California v Hyatt

Article IV’s Full Faith and Credit Clause states:

Full faith and credit shall be given in each state to the public acts, records, and judicial proceedings of every other state. And the Congress may by general laws prescribe the manner in which such acts, records, and proceedings shall be proved, and the effect thereof.

When interpreting the Full Faith and Credit Clause, the Supreme Court has acknowledged that the Constitution “does not require a State to substitute for its own statute, applicable to persons and events within it, the statute of another State reflecting a conflicting and opposed policy.” However, the Court has also emphasized that State must “not adopt any policy of hostility to the public Acts” of that other State.

The Majority Decision in Franchise Tax Board of California v Hyatt

The Supreme Court split 4-4 with regard to whether Hall should be overruled, which resulted in “affirmance of Nevada’s exercise of jurisdiction over California’s state agency.”

On the merits, the majority reversed the Nevada Supreme Court’s decision, holding that Nevada “applied a special rule of law that evinces a ‘policy of hostility’ toward California.”

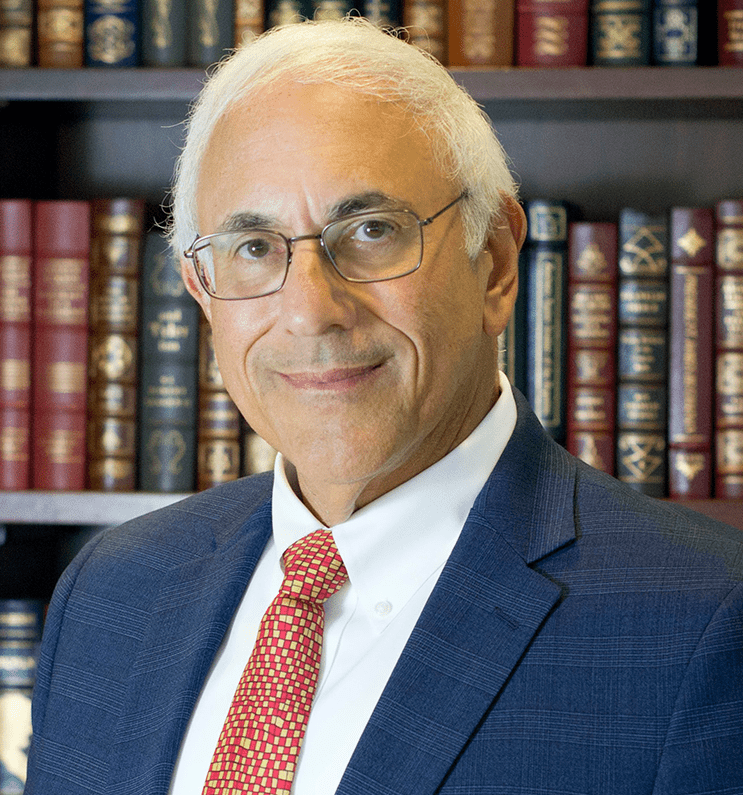

Justice Breyer delivered the opinion of the Court, and was joined by Justices Ruth Bader Ginsburg, Elena Kagan, Anthony Kennedy, Sonia Sotomayor. Justice Samuel Alito concurred in the judgment.

According to the majority, the Constitution does not permit Nevada to award damages against California agencies under Nevada law that are greater than it could award against Nevada agencies in similar circumstances. “Nevada has not applied the principles of Nevada law ordinarily applicable to suits against Nevada’s own agencies. Rather, it has applied a special rule of law applicable only in lawsuits against its sister States, such as California,” Justice Breyer wrote.

In reaching its decision, the majority highlighted that it was not returning to the “complex ‘balancing-of-interests approach to conflicts of law under the Full Faith and Credit Clause.’” As Justice Breyer stated, “Rather, Nevada’s hostility toward California is clearly evident in its decision to devise a special, discriminatory damages rule that applies only to a sister State.”

The Dissent in Franchise Tax Board of California v Hyatt

Chief Justice John Roberts filed a dissenting opinion in which Justice Clarence Thomas joined. While the Chief Justice acknowledged that the majority’s decision was fair, he maintained that it failed to comply with the Full Faith and Credit Clause. “[F]or better or worse, the word ‘fair’ does not appear in the Full Faith and Credit Clause,” he wrote.

As the Chief Justice further argued:

The Court’s decision is contrary to our precedent holding that the Clause does not block a State from applying its own law to redress an injury within its own borders. The opinion also departs from the text of the Clause, which— when it applies—requires a State to give full faith and credit to another State’s laws. The Court instead permits partial credit: To comply with the Full Faith and Credit Clause, the Nevada Supreme Court need only afford the Board the same limited immunity that Nevada agencies enjoy.

Previous Articles

Supreme Court Hold Ex Post Facto Clause Applies to Criminal Restitution Statute

by DONALD SCARINCI on March 6, 2026

In Ellingburg v. United States, 607 U.S. ____ (2026), the U.S. Supreme Court unanimously heldthat t...

SCOTUS Reaffirms Fourth Amendment Standard for Police Responding to Household Emergencies

by DONALD SCARINCI on February 19, 2026

In Case v. Montana, 607 U.S. ____ (2026), the U.S. Supreme Court confirmed thatthe Fourth Amendment...

SCOTUS Decision in Bowe v. United States Is First of the 2026 Term

by DONALD SCARINCI on February 5, 2026

In Bowe v. United States, 607 U.S. ___ (2026), the U.S. Supreme Court held that Title 28 U.S.C. § ...

The Amendments

-

Amendment1

- Establishment ClauseFree Exercise Clause

- Freedom of Speech

- Freedoms of Press

- Freedom of Assembly, and Petitition

-

Amendment2

- The Right to Bear Arms

-

Amendment4

- Unreasonable Searches and Seizures

-

Amendment5

- Due Process

- Eminent Domain

- Rights of Criminal Defendants

Preamble to the Bill of Rights

Congress of the United States begun and held at the City of New-York, on Wednesday the fourth of March, one thousand seven hundred and eighty nine.

THE Conventions of a number of the States, having at the time of their adopting the Constitution, expressed a desire, in order to prevent misconstruction or abuse of its powers, that further declaratory and restrictive clauses should be added: And as extending the ground of public confidence in the Government, will best ensure the beneficent ends of its institution.