California Public Employees’ Retirement System v ANZ Securities: Supreme Court Clarifies Tolling in Securities Class Actions

In California Public Employees’ Retirement System v ANZ Securities, Inc., et al., 582 U. S. ____ (2017), the U.S. Supreme Court held that the Securities Act of 1933’s (Securities Act) three-year statute of repose is not subject to tolling. Accordingly, it held that the California Public Employees’ Retirement System’s untimely filing of its individual action was grounds for dismissal.

Legal Background in California Public Employees’ Retirement System v ANZ Securities

Section 11 of the Securities Act of 1933 grants purchasers of securities “a right of action against an issuer or designated individuals” for any material misstatements or omissions in a registration statement. Section 13 establishes two-time restrictions for suits brought under Section 11. The first sentence states that an action “must be brought within one year after the discovery of the untrue statement or the omission, or after such discovery should have been made by the exercise of reasonable diligence…” The second sentence provides that “[i]n no event shall any such action be brought . . . more than three years after the security was bona fide offered to the public…”

Facts of California Public Employees’ Retirement System v ANZ Securities

In 2007 and 2008, Lehman Brothers Holdings Inc. raised capital through several public securities offerings. Petitioner California Public Employees’ Retirement System (CalPERS or Petitioner), the largest public pension fund in the country, purchased some of those securities. Its lawsuit alleges that respondents, various financial firms, are liable under the Securities Act for their participation as underwriters in the transactions. In 2008, a putative class action was filed against respondents in the Southern District of New York. The complaint raised Section 11 claims, alleging that the registration statements for certain of Lehman’s 2007 and 2008 securities offerings included material misstatements or omissions. Because the complaint was filed on behalf of all persons who purchased the identified securities, CalPERS was a member of the putative class.

In February 2011, which was more than three years after the relevant securities offerings, CalPERS filed a separate complaint against respondents in the Northern District of California, alleging violations identical to those in the class action. Soon thereafter, a proposed settlement was reached in the putative class action, but CalPERS opted out of the class. Respondents then moved to dismiss CalPERS’ individual suit, alleging that the Section 11 violations were untimely under the three-year bar in the second sentence of Section 13.

In response, CalPERS argued that the three-year period was tolled during the pendency of the class-action filing, relying on American Pipe & Construction Co. v. Utah, 414 U. S. 538 (1974). The trial court disagreed, and the Second Circuit affirmed, holding that American Pipe’s tolling principle is inapplicable to the three-year bar. It also rejected CalPERS’ alternative argument that the timely filing of the class action made petitioner’s individual claims timely as well.

Court’s Decision in California Public Employees’ Retirement System v ANZ Securities

By a vote of 5-4, the U.S. Supreme Court held that “Petitioner’s untimely filing of its individual complaint more than three years after the relevant securities offering is ground for dismissal.” Justice Anthony Kennedy authored the Court’s opinion, in which Chief Justice Roberts and Justices Thomas, Alito, and Gorsuch joined.

The Court’s majority decision rests on its determination that Section 13’s three-year time limit is a statute of repose not subject to equitable tolling. “From the structure of §13, and the language of its second sentence, it is evident that the 3-year bar is a statute of repose,” Justice Kennedy explained. “The instruction that ‘[i]n no event’ shall an action be brought more than three years after the relevant securities offering admits of no exception. The statute also runs from the defendant’s last culpable act (the securities offering), not from the accrual of the claim (the plaintiff’s discovery of the defect).”

In determining that the tolling rule was inapplicable, the majority noted that [t]olling is permissible only where there is a particular indication that the legislature did not intend the statute to provide complete repose but instead anticipated the extension of the statutory period under certain circumstances.” The majority also distinguished its decision in American Pipe, highlighting that “[t]he tolling decision in American Pipe derived from equity principles and therefore cannot alter the unconditional language and purpose of the 3-year statute of repose.”

The Dissent in California Public Employees’ Retirement System v ANZ Securities

Justice Ruth Bader Ginsburg filed a dissenting opinion, in which Justices Breyer, Sotomayor, and Kagan joined. The dissenters argued that the filing of the class complaint commenced CalPERS’ action under Section 11 of the Securities Act, thereby satisfying Section 13’s statute of repose.

“Today’s decision disserves the investing public that §11 was designed to protect. The harshest consequences will fall on those class members, often least sophisticated, who fail to file a protective claim within the repose period,” Justice Ginsburg wrote. “Absent a protective claim filed within that period, those members stand to forfeit their constitutionally shielded right to opt out of the class and thereby control the prosecution of their own claims for damages.

Previous Articles

Supreme Court Rejects Moment of Threat Doctrine in Deadly Force Case

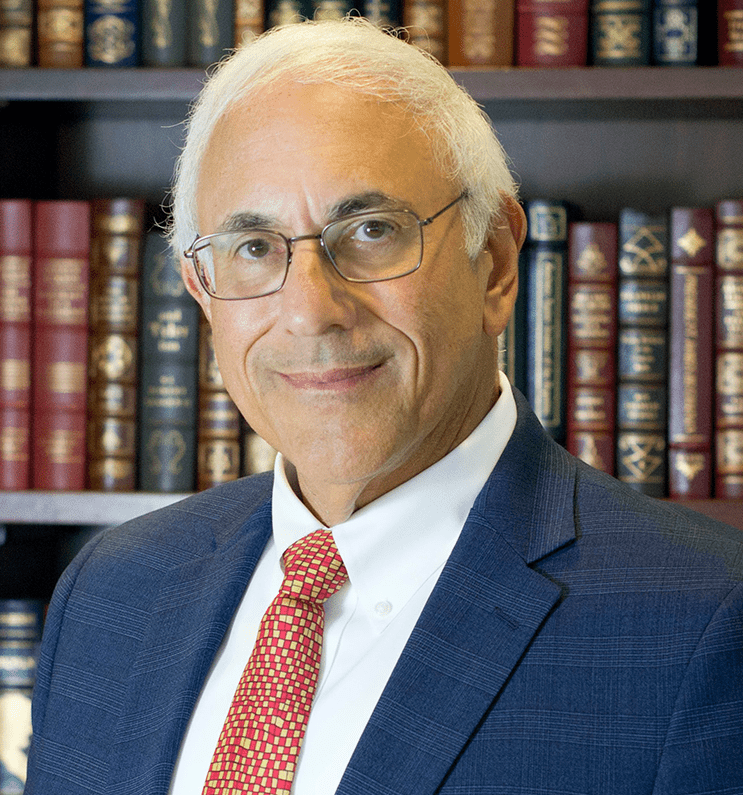

by DONALD SCARINCI on June 30, 2025

In Barnes v. Felix, 605 U.S. ____ (2025), the U.S. Supreme Court rejected the Fifth Circuit Court o...

SCOTUS Holds Wire Fraud Statute Doesn’t Require Proof Victim Suffered Economic Loss

by DONALD SCARINCI on June 24, 2025

In Kousisis v. United States, 605 U.S. ____ (2025), the U.S. Supreme Court held that a defendant wh...

SCOTUS Holds Wire Fraud Statute Doesn’t Require Proof Victim Suffered Economic Loss

by DONALD SCARINCI on June 17, 2025

In Kousisis v. United States, 605 U.S. ____ (2025), the U.S. Supreme Court held that a defendant wh...

The Amendments

-

Amendment1

- Establishment ClauseFree Exercise Clause

- Freedom of Speech

- Freedoms of Press

- Freedom of Assembly, and Petitition

-

Amendment2

- The Right to Bear Arms

-

Amendment4

- Unreasonable Searches and Seizures

-

Amendment5

- Due Process

- Eminent Domain

- Rights of Criminal Defendants

Preamble to the Bill of Rights

Congress of the United States begun and held at the City of New-York, on Wednesday the fourth of March, one thousand seven hundred and eighty nine.

THE Conventions of a number of the States, having at the time of their adopting the Constitution, expressed a desire, in order to prevent misconstruction or abuse of its powers, that further declaratory and restrictive clauses should be added: And as extending the ground of public confidence in the Government, will best ensure the beneficent ends of its institution.