Steward Machine Company v Davis Upholds Social Security Tax

Historical

In Steward Machine Company v Davis, 301 U.S. 548 (1937), the U.S. Supreme Court held that the provisions of the Social Security Act that funded unemployment compensation were constitutional. The case reaffirmed that Congress could take national action for the general welfare.

Facts of Steward Machine Company v Davis

The provision at issue, Title IX of the Social Security Act, imposed a tax on employers of eight or more employees to fund unemployment compensation. If, however, a state had established an approved unemployment compensation plan, the taxpayer was allowed to credit up to 90 percent of the federal tax paid to the state unemployment fund.

An Alabama corporation paid a tax in accordance with the statute and then filed a claim for refund with the Commissioner of Internal Revenue. It subsequently filed suit to recover the payment ($46.14), asserting a conflict between the statute and the Constitution of the United States. The District Court dismissed, and the Circuit Court of Appeals for the Fifth Circuit affirmed.

The Supreme Court granted certiorari. As described in the Court’s opinion:

The question is to be answered whether the expedient adopted has overlept the bounds of power. The assailants of the statute say that its dominant end and aim is to drive the state legislatures under the whip of economic pressure into the enactment of unemployment compensation laws at the bidding of the central government.

The Majority Decision in Steward Machine Company v Davis

By a vote of 5-4, the Court held that the tax imposed under the Social Security Act was a valid exercise of congressional power under the Constitution. “The excise is not void as involving the coercion of the States in contravention of the Tenth Amendment or of restrictions implicit in our federal form of government,” Justice Benjamin N. Cardozo wrote on behalf of the majority.

In concluding that the tax would benefit the general welfare, the majority highlighted the dire state of the economy.

The fact developed quickly that the states were unable to give the requisite relief. The problem had become national in area and dimensions. There was need of help from the nation if the people were not to starve. It is too late today for the argument to be heard with tolerance that, in a crisis so extreme, the use of the moneys of the nation to relieve the unemployed and their dependents is a use for any purpose narrower than the promotion of the general welfare.

According to the majority, the Social Security Act would benefit both the states and the federal government. “Title IX may be sustained as a cooperative plan whereby States may be set free to provide unemployment compensation without subjecting themselves to economic disadvantages resulting from the absence of such provision in other States, and whereby, through the assumption of such burdens by the States generally, the financial burden of the Nation due to unemployment may be correspondingly decreased,” Justice Cardoza explained.

The majority further rejected the argument that Social Security Act provision was void as involving an unconstitutional attempt to coerce the States to adopt unemployment compensation legislation approved by the Federal Government. As Justice Cardoza explained:

The difficulty with the petitioner’s contention is that it confuses motive with coercion. “Every tax is in some measure regulatory. To some extent it interposes an economic impediment to the activity taxed as compared with others not taxed.” Sonzinsky v. United States. In like manner every rebate from a tax when conditioned upon conduct is in some measure a temptation. But to hold that motive or temptation is equivalent to coercion is to plunge the law in endless difficulties. … Nothing in the case suggests the exertion of a power akin to undue influence … the location of the point at which pressure turns into compulsion, and ceases to be inducement, would be a question of degree.

The Dissent in Steward Machine Company v Davis

The dissenters viewed the Social Security Act as a Congressional overreach. “That portion of the Social Security legislation here under consideration, I think, exceeds the power granted to Congress,” Justice James McReynolds wrote. “It unduly interferes with the orderly government of the state by her own people and otherwise offends the Federal Constitution…. [Article 1, Section 8] is not a substantive general power to provide for the welfare of the United States, but is a limitation on the grant of power to raise money by taxes, duties, and imposts.” He added: “If it were otherwise, all the rest of the Constitution, consisting of carefully enumerated and cautiously guarded grants of specific powers, would have been useless, if not delusive.”

Previous Articles

Supreme Court Rejects Mexico’s Suit Against U.S. Gun Manufacturers

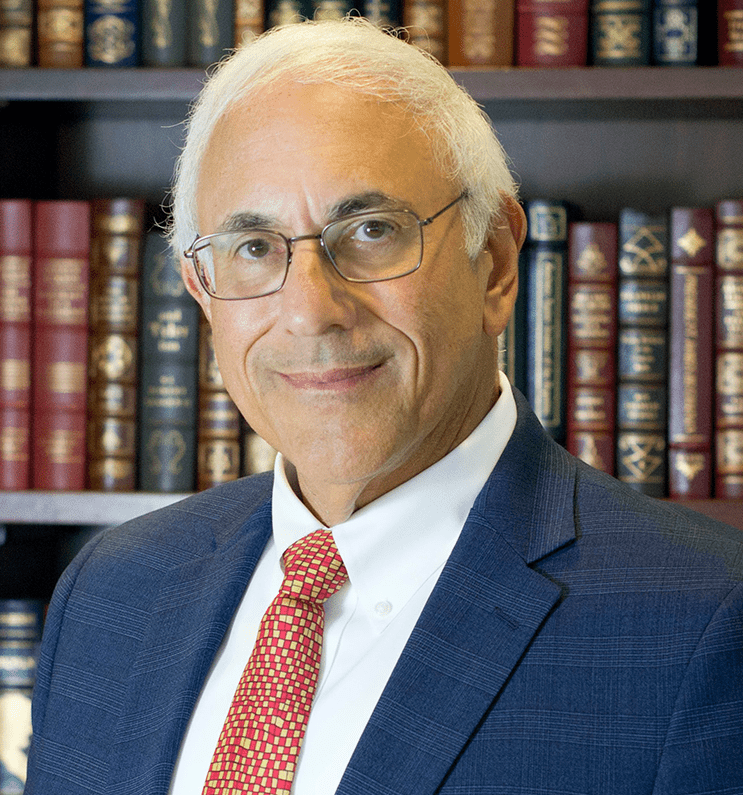

by DONALD SCARINCI on July 8, 2025

In Smith & Wesson Brands v. Estados Unidos Mexicanos, 605 U.S. ____ (2025), the U.S. Supreme Co...

SCOTUS Sides With Employee in Reverse Discrimination Case

by DONALD SCARINCI on July 2, 2025

In Ames v. Ohio Department of Youth Services, 605 U.S. ____ (2025), the U.S. Supreme Court held tha...

Supreme Court Rejects Moment of Threat Doctrine in Deadly Force Case

by DONALD SCARINCI on June 30, 2025

In Barnes v. Felix, 605 U.S. ____ (2025), the U.S. Supreme Court rejected the Fifth Circuit Court o...

The Amendments

-

Amendment1

- Establishment ClauseFree Exercise Clause

- Freedom of Speech

- Freedoms of Press

- Freedom of Assembly, and Petitition

-

Amendment2

- The Right to Bear Arms

-

Amendment4

- Unreasonable Searches and Seizures

-

Amendment5

- Due Process

- Eminent Domain

- Rights of Criminal Defendants

Preamble to the Bill of Rights

Congress of the United States begun and held at the City of New-York, on Wednesday the fourth of March, one thousand seven hundred and eighty nine.

THE Conventions of a number of the States, having at the time of their adopting the Constitution, expressed a desire, in order to prevent misconstruction or abuse of its powers, that further declaratory and restrictive clauses should be added: And as extending the ground of public confidence in the Government, will best ensure the beneficent ends of its institution.