Menu

Hot-Topics

February 5, 2026 | SCOTUS Decision in Bowe v. United States Is First of the 2026 Term

Author: DONALD SCARINCI

Downes v. Bidwell: Does the Constitution Follow the Flag?

Downes v. Bidwell: Does the Constitution Follow the Flag? In Downes v. Bidwell, 182 U.S. 244 (1901), the U.S. Supreme Court held that the rights and protections of the Constitution do not automatically apply to U.S. territories. The case is one of t...

Welch v. United States: Landmark Sentencing Decision Must Be Applied Retroactively

Welch v. United States: Landmark Sentencing Decision Must Be Applied Retroactively On April 18, 2016, the U.S. Supreme Court held that its landmark criminal sentencing decision in Johnson v. United States must be applied retroactively. The justices ...

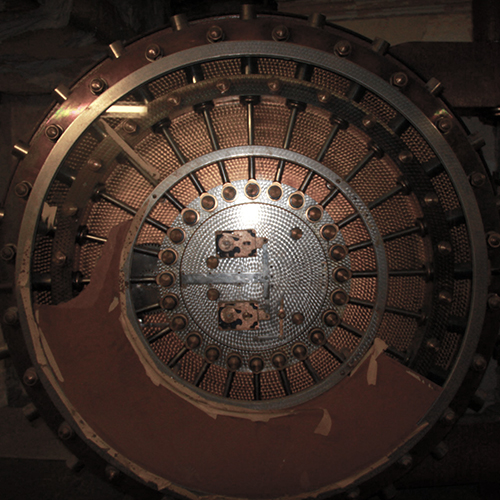

The Sixteenth Amendment: The Federal Income Tax

The Sixteenth Amendment: The Federal Income Tax The Sixteenth Amendment to the U.S. Constitution eliminated the requirement that federal taxes be levied on individuals in proportion with the populations of their states. The amendment cleared the way...

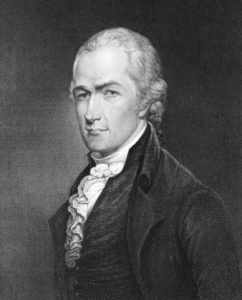

Bank of the United States v Deveaux: The Citizenship of Corporations

Bank of the United States v Deveaux: The Citizenship of Corporations In Bank of the United States v. Deveaux, 5 Cranch 61 (1809), the U.S. Supreme Court first considered the citizenship of corporations for the purposes of diversity jurisdiction. The...

Franchise Tax Board of California v Hyatt: Applying the Full Faith and Credit Clause

Franchise Tax Board of California v Hyatt: Applying the Full Faith and Credit Clause On April 19, 2016, the Supreme Court reached another 4-4 tie. In Franchise Tax Board of California v Hyatt, the justices could not decide whether to overrule Nevada...

Ware v Hylton: Supreme Court Power to Invalidate State Laws

Ware v Hylton: Supreme Court Power to Invalidate State Laws In Ware v. Hylton, 3 U.S. (3 Dall.) 199 (1796), the U.S. Supreme Court held that the federal courts are authorized to determine the constitutionality of state laws. The Court subsequently h...

Heffernan v City of Paterson: SCOTUS Examines Employee Rights under the First Amendment

Heffernan v City of Patterson In Heffernan v.City of Patterson, the U.S. Supreme Court held that when an employer demotes an employee out of a desire to prevent the worker from engaging in protected political activity, the employee is entitled to ch...

Hylton v United States: Apportionment of Direct Taxes

In Hylton v United States, the U.S. Supreme Court upheld an annual tax on carriages was a valid exercise of Congress’ constitutional authority. It specifically ruled that the tax was not a direct tax that required compliance with Article 1’s ...

Bank Markazi v. Peterson: Court Rules for Terrorism Victims in Article III Case

In Bank Markazi v. Peterson, 578 U. S. ____ (2016), the U.S. Supreme Court held that Section 8772 of the Iran Threat Reduction and Syria Human Rights Act of 2012 does not violate the separation of powers. Congress enacted the statute to ensure that a...

Selective Draft Law Cases Hold Conscription Is Constitutional

In Arver v. United States, 245 U.S. 366 (1918), the U.S. Supreme Court held that Congress was authorized under the Constitution to compel military service pursuant to the Selective Service Act of 1917. The consolidated cases are also known as the...

Previous Articles

SCOTUS Rules State Can’t Immunize Parties from Federal Civil Liability

by DONALD SCARINCI on January 29, 2026

In John Doe v. Dynamic Physical Therapy, LLC, 607 U.S. ____ (2025) the U.S. Supreme Court held that...

Supreme Court to Address Racial Discrimination in Jury Selection

by DONALD SCARINCI onWhile the U.S. Supreme Court has concluded oral arguments for the year, it continues to add cases t...

Supreme Court Halts Deployment of National Guard to Chicago

by DONALD SCARINCI on

In Trump v. Illinois, 607 U.S. ____ (2025), the U.S. Supreme Court refused to stay a district court...

The Amendments

-

Amendment1

- Establishment ClauseFree Exercise Clause

- Freedom of Speech

- Freedoms of Press

- Freedom of Assembly, and Petitition

-

Amendment2

- The Right to Bear Arms

-

Amendment4

- Unreasonable Searches and Seizures

-

Amendment5

- Due Process

- Eminent Domain

- Rights of Criminal Defendants

Preamble to the Bill of Rights

Congress of the United States begun and held at the City of New-York, on Wednesday the fourth of March, one thousand seven hundred and eighty nine.

THE Conventions of a number of the States, having at the time of their adopting the Constitution, expressed a desire, in order to prevent misconstruction or abuse of its powers, that further declaratory and restrictive clauses should be added: And as extending the ground of public confidence in the Government, will best ensure the beneficent ends of its institution.

Awards